Have You Ever Received A School Tax Bill, In Your Name, For The Property You Wish To Register?

Tax bills are more often than not mailed to holding owners xxx days prior to the holding tax due date. Contact your boondocks to observe out the tax due appointment. If the tax due date falls on a weekend or a vacation, taxes are generally due the following business day.

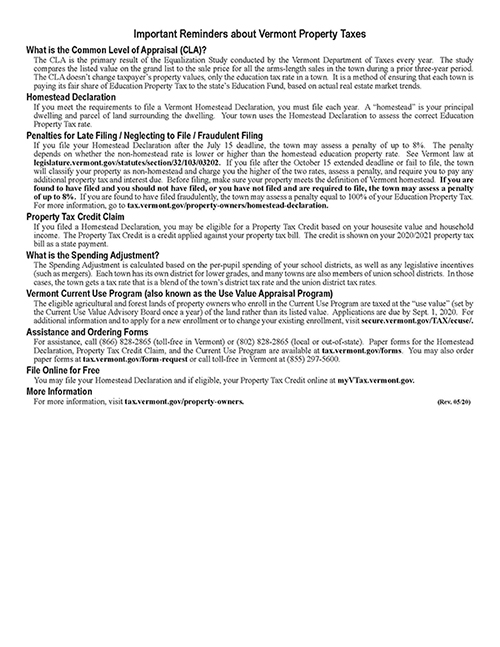

Overview

Hither is a typical Vermont holding taxation beak. The format varies from town to town, so your bill may not look exactly like this sample. The Vermont Department of Taxes uses information and terms common to all property tax bills. Our intent is to show where requested information may be found.

Section one

- A town may employ "Business relationship Number" or "Package ID" to identify the billing business relationship.

- Belongings description, if shown

- Current owner's mailing address or owner by deed. Ownership should be current equally of Apr 1. If not, notify the municipality.

- Notice to forward the tax bill to the new owner(due south) if the property is transferred subsequently bill is received

- The Housesite Taxation Information box contents are used to calculate any land payments that are adjusted for income. The data is reportable on certain state tax forms, e.g. the IN-111 Income Taxation Return, HS-122 Homestead Declaration, HI-144 Property Tax Credit Claim, and LRC-140 Vermont Landlord Document. The xi-digit SPAN and the three-digit School Code are commonly required by the Department of Taxes.

Property Revenue enhancement Rates

- Municipal Tax Rates:The municipal legislative body (most often with the advice of the treasurer) sets the tax charge per unit or rates needed to raise money for municipality highway and general fund expenses. The municipal rate is levied against the municipal grand listing.

- Educational activity Revenue enhancement Rates:A homestead education tax rate and a nonhomestead education tax charge per unit are set annually past the commissioner of taxes. The education tax rates are to exist levied confronting all homestead and nonhomestead parcels on the education m listing

About the Pedagogy Tax Rates

There are ii education taxation rates: homestead and nonhomestead. Bills may testify ane or both rates. If you lot filed a Homestead Announcement (HS-122) this twelvemonth and have no business or rental use, your bill will show only the homestead instruction charge per unit. If you filed the HS-122 and you have business and/or rental apply, your bill should show both the homestead and nonhomestead rates based on the relative percentage of homestead and business or rental use.

If the property is non your principal residence, y'all cannot declare information technology as your homestead. Your bill will show only the nonhomestead rate.

Learn more about how the education revenue enhancement rates are gear up.

Section 2

- Total property value, as adamant by local assessing officials. If you lot are entitled to a partial tax exemption of any kind, this deduction will announced hither. See Notes on Exemptions, below.

- Homestead and nonhomestead assessed values are portions of the total assessed value. If yous filed an HS-122 and you take business organization and/or rental use, your cess will exist split. Your business and/or rental utilise will show as nonhomestead.

- Local taxation rates, voted on at boondocks coming together at controlled locally, and exemptions.

- Didactics taxation data: homestead and/or nonhomestead tax rates for the statewide education property tax

- Your total combined state and local property taxes, before any adjustments

- The Country payment is the Holding Tax Credit. It reduces the amount of tax owed.

- Your total municipal (local) property tax liability

- Installment due dates and payment stubs (not shown) vary from town to town. Towns transport out taxation bills only once a year, but may accept almanac, semi-annual, or quarterly payment due dates

Back of the Holding Tax Bill

Here is an example of the printed linguistic communication from the back of the property taxation beak.

Notes on Exemptions

Contract exemptions are for special circumstances where a municipality reduces the value on a portion of property being used for a public purpose, or where other exemptions exist by country law. Some municipalities also have community-specific stabilization agreements.

The Veterans Property Exemption is available if yous meet the criteria, by applying to the Vermont Part of Veterans Affairs. There is also a Land Use Exemption, also known equally Electric current Use. Acquire more about the Electric current Use Plan.

Have You Ever Received A School Tax Bill, In Your Name, For The Property You Wish To Register?,

Source: http://tax.vermont.gov/property/property-tax-bill

Posted by: beasleypecom1994.blogspot.com

0 Response to "Have You Ever Received A School Tax Bill, In Your Name, For The Property You Wish To Register?"

Post a Comment